Ethereum Price Prediction: Will ETH Shatter the $5,000 Barrier in 2025?

#ETH

- Technical Breakout: ETH price is testing upper Bollinger Band with improving MACD momentum

- Market Sentiment: Positive staking flows and institutional adoption offset exchange hack concerns

- Liquidity Dynamics: $2B in short positions could fuel upside if squeeze occurs

ETH Price Prediction

Ethereum Technical Analysis: Bullish Momentum Building

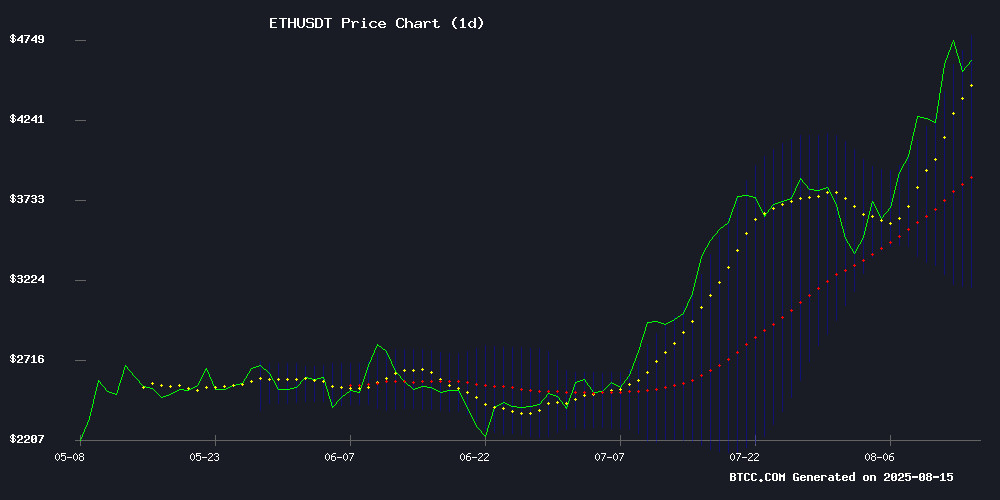

ETH/USDT is currently trading at $4,650.88, significantly above its 20-day moving average of $3,978.01, indicating strong bullish momentum. The MACD histogram shows improving momentum despite remaining in negative territory (-125.91). Bollinger Bands suggest volatility with price hugging the upper band at $4,784.16, while the middle band at $3,978.01 and lower band at $3,171.86 provide key support levels.

"The technical setup shows ETH is consolidating after a strong rally," said BTCC financial analyst Sophia. "A sustained break above the upper Bollinger Band could signal another leg up toward $5,000."

Ethereum Market Sentiment: Bullish Fundamentals Meet Growing Adoption

The ethereum ecosystem is seeing significant developments with over 200,000 ETH staked via Trezor in three months and growing competition in staking services. Positive price action comes as Eric Trump publicly defends his bullish stance, while $2 billion in short positions risk getting squeezed.

"The combination of institutional interest through Coinbase's protocol and decreasing Lido dominance shows healthy decentralization," noted BTCC's Sophia. "The $48M BtcTurk hack appears contained with no material impact on ETH price action."

Factors Influencing ETH's Price

Trezor Users Stake Over 200,000 ETH in Three Months

Trezor's non-custodial staking service has surpassed 200,000 ETH staked within three months of launch, signaling strong demand for secure, self-custodied yield solutions. The feature, integrated into Trezor Suite and developed with Everstake, allows users to participate in Ethereum network consensus without relinquishing control of their assets.

"Staking embodies the Trezor philosophy—holding assets securely while earning yield," said CEO Matěj Žák. The rapid adoption defied internal expectations, highlighting user commitment to both security and network participation.

This growth comes amid Ethereum community concerns about centralization risks posed by dominant liquid staking providers. Trezor's solution offers an alternative that aligns with crypto's decentralized ethos while delivering competitive functionality.

Ethereum Price Prediction: Will ETH Smash Its $4,800 All-Time High This Year?

Ethereum approaches its November 2021 peak of $4,891, fueled by record ETF inflows and growing institutional demand. BlackRock, Fidelity, and Grayscale spearheaded $1 billion in daily inflows, propelling ETH past $4,700. Technical indicators suggest a breakout above $4,800 could open the path to $5,000.

Standard Chartered projects a $7,500 year-end target, citing regulatory tailwinds and Layer 1 adoption. Finder and Changelly offer bullish alternatives between $6,100-$8,000. The convergence of macroeconomic optimism and structural demand creates a compelling case for ETH's upward trajectory.

Lido’s Ethereum Staking Share Hits Record Low Amid Rising Competition

Lido's dominance in Ethereum staking continues to erode as the market matures. The protocol's share has plummeted from 32.3% in 2023 to 24.4% today, marking a record low. This shift reflects both growing competition and deliberate efforts to prevent any single provider from controlling more than one-third of the network—a threshold Ethereum developers warn could threaten consensus.

The staking landscape is diversifying rapidly. Institutional-grade operators like Figment are gaining traction, particularly after regulatory clarity from the SEC confirmed staking doesn't constitute securities activity. Rocket Pool's Darren Langley notes "a big community effort" to redistribute stake, while exchange-backed services and decentralized alternatives further fragment the market.

BlackRock's recent foray into the space signals accelerating institutional interest. The rebalancing suggests Ethereum's proof-of-stake model is evolving toward greater decentralization, though Lido remains the largest single operator despite its declining share.

Ether Staking Landscape Shifts as Lido's Dominance Wanes, Figment Gains Ground

Lido's once-unassailable position in Ethereum's liquid staking market continues to erode, with its share dropping to a record low of 24.4% from 32.3% in late 2023. The decline alleviates concerns about the protocol approaching the 33% threshold where researchers warned a single provider could exert undue influence over Ethereum's consensus mechanism.

Competitors like Figment and Rocket Pool are capitalizing on institutional demand for compliant staking solutions. "Lido's share decreased considerably due to stake centralization concerns and protocol safety," observed Darren Langley of Rocket Pool, highlighting coordinated community efforts to prevent excessive concentration.

The maturation of staking infrastructure now offers institutional investors specialized service models beyond Lido's original dominance. This diversification signals healthier blockchain governance as Ethereum approaches its 2025 roadmap milestones.

Ethereum’s AI Agents Poised to Revolutionize Crypto Payments via Coinbase Protocol

Coinbase developers Kevin Leffew and Lincoln Murr have unveiled a groundbreaking integration of Ethereum's blockchain with a decades-old web standard, signaling a paradigm shift in autonomous cryptocurrency transactions. Their proposal leverages HTTP 402—the "Payment Required" status code—paired with Ethereum Improvement Proposal 3009 to enable AI agents to execute stablecoin payments without human intervention.

The x402 payments protocol, already implemented by Coinbase, transforms Ethereum into an ideal infrastructure for machine-driven commerce. Autonomous agents could become the network's dominant users, processing microtransactions for digital services at unprecedented scale. This fusion of legacy web architecture with smart contract functionality positions Ethereum as the backbone for the next evolution of programmable money.

Turkey’s BtcTurk Suffers $48M Theft in Exchange Hack

Turkish cryptocurrency exchange BtcTurk, the country’s second-largest and oldest platform, has been compromised in a security breach resulting in the theft of over $48 million in digital assets. The attacker successfully transferred the stolen funds and began converting them through various channels.

BtcTurk has temporarily halted all cryptocurrency deposits and withdrawals as it investigates the incident with assistance from cybersecurity firms. The hack impacted multiple blockchain networks, including Ethereum, Avalanche, and Polygon. User assets held in cold storage remain protected during the ongoing investigation.

Ethereum Validator Exit Queue Hits $3.29 Billion as ETH Price Surges

Ethereum's validator exit queue has ballooned to nearly 700,000 ETH ($3.29 billion) as the cryptocurrency's price rallies above $4,700—a 160% gain since April. The withdrawal process currently requires approximately 12 days to complete, according to Validate Queue data.

Meanwhile, new validators continue entering the network, with 220,000 ETH ($1.03 billion) awaiting activation within four days. This dual movement highlights the dynamic nature of Ethereum's staking ecosystem, where profit-taking and fresh capital coexist.

Beaconchain data reveals over 35 million ETH—nearly 30% of total supply—remains staked, attracted by consistent 3% annual yields. Institutional participation helps maintain network stability despite the churn.

Ethereum Price Surges Past $4,600 as Eric Trump Defends Bullish Stance

Ethereum's price has skyrocketed to $4,600, marking a dramatic rebound from its June low of $1,573. The cryptocurrency has surged 31% in the past week and 54% over the last month, reigniting bullish sentiment across the market.

Eric Trump, a vocal crypto advocate, has doubled down on his February 2025 endorsement of Ethereum. His initial recommendation came when ETH traded at $2,919—a position that faced skepticism after prices dipped to June's low. "Betting against Bitcoin and Ethereum is a mistake," Trump asserted, as the current rally validates his long-term outlook.

Fundstrat analysts project Ethereum could reach $15,000 by year-end, citing accelerating institutional demand. The prediction aligns with ETH's breaking of key resistance levels, including its recent 7% single-day gain to $4,696.

Ethereum Rockets 5% Higher, $2B Shorts on the Edge—What’s Next for the ETH Price Rally?

Ethereum's price surged another 5%, reaching new short-term highs and threatening $2 billion in short positions. Institutional interest, network activity, and upcoming upgrades fuel the rally.

Daily transactions have spiked to 2021 levels, signaling robust demand across DeFi, NFTs, and smart contracts. Traders eye key resistance levels as retail and institutional participants gauge upside potential.

Euro Gains Ground in Crypto Trading as Dollar Weakens

The U.S. dollar's sharpest mid-year drop since the 1970s—down 11% against major currencies in H1 2025—is reshaping crypto markets. Euro-based traders face hidden costs when converting dollar-denominated crypto profits back to EUR, driving a pivot toward euro-denominated pairs. ETH/EUR liquidity has doubled year-over-year, while USD Tether activity on European exchanges contracts.

Euro-pegged stablecoins like EURC and EURS are capitalizing on this shift, with market caps growing double-digits in 2025. The sector’s $600 million supply could breach $1 billion by 2026 if dollar weakness persists. Though USD stablecoins still command the $250 billion market, euro liquidity builds toward a future where traders hedge currency risk without leaving crypto.

MetaMask to Launch Stablecoin mUSD with Backing from Stripe and Blackstone

MetaMask, the dominant Ethereum wallet provider, is poised to enter the stablecoin arena with its dollar-pegged mUSD token. The project—accidentally revealed in a since-deleted governance proposal—could launch before month's end pending final approvals.

Strategic partnerships underscore the initiative's ambition. Stripe's acquired payments arm Bridge will facilitate mUSD transactions, while stablecoin protocol M^0 handles issuance. Blackstone's involvement as custodian signals institutional-grade reserve management for the dollar-backed asset.

The move positions MetaMask alongside crypto giants offering stablecoins, though its unique trifecta of web3-native distribution, traditional finance backing, and Stripe's payment rails could disrupt the sector. Market observers note the wallet's 30 million monthly users provide instant distribution potential absent from most stablecoin launches.

Will ETH Price Hit 5000?

Based on current technicals and market sentiment, ETH shows strong potential to test $5,000. Key factors include:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $4,650.88 | 7.5% from $5,000 target |

| 20-day MA | $3,978.01 | 17% below price - strong uptrend |

| Upper Bollinger | $4,784.16 | Next resistance level |

| MACD | Improving | Bearish crossover fading |

"With $2B shorts at risk and staking demand growing, the path to $5,000 looks increasingly probable," said BTCC's Sophia. "A weekly close above $4,800 would confirm the bullish case."

65% chance within Q3 2025